Investing in America’s Greatest Asset

The Premier Agency Residential Mortgage REIT

We are an internally managed mortgage REIT built with the objective of generating favorable long-term stockholder returns with a substantial yield component through levered investments in Agency residential mortgage-backed securities.

Market Capitalization

Total Stock Return Since IPO

Dividend Yield

Where Investing Creates Opportunity

Since inception, we have remained committed to an actively managed Agency MBS investment strategy to provide stockholders attractive long-term returns through exposure to a highly impactful asset class.

The Opportunity

Agency-guaranteed residential MBS investments paired with highly attractive funding

The Objective

Favorable long-term stockholder returns with a substantial yield component

The Impact

Permanent capital supporting American homeownership across generations

Powerful Asset. Premier Approach.

Our distinct approach to investing drives stockholder returns through a dynamic combination of unique capabilities.

Asset Selection Expertise

Competitive Funding Advantages

Disciplined Risk Management

Corporate Responsibility

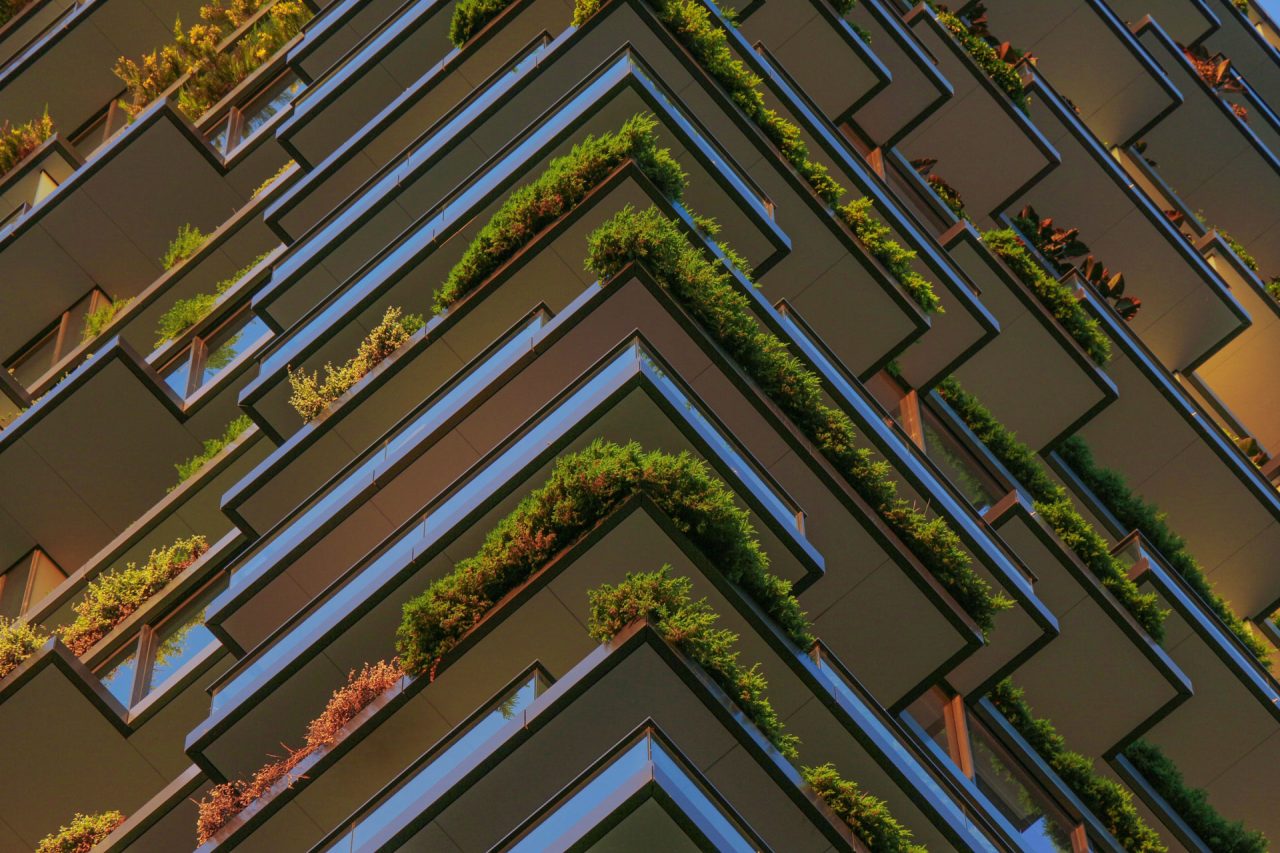

AGNC invests with an understanding and awareness of the potential impact we have on the economy, the environment, and society, and we are committed to being an industry leader in corporate responsibility through continuous evolution and improvement.

AGNC is led by an experienced team that has navigated market cycles to produce a compelling track record of outperformance since the Company’s inception. Our focus on Agency MBS, coupled with our unwavering commitment to responsible stewardship of our investors’ capital, has created a best-in-class investment vehicle to access this market.

Peter J. Federico, President & CEO

Our remarkable long-term performance has been driven by an attractive dividend, which provides substantial monthly income for stockholders. As a private capital investor in the U.S. mortgage market, we drive wealth creation for both our investors, who benefit from favorable total returns, and homeowners, whom our investments support.

Bernice Bell, Executive Vice President & CFO

Stock quote data provided by Refinitiv. Minimum 15 minutes delayed.