THE EARNINGS Extract

Q3 2024 EARNINGS COMMENTARy

october 22, 2024

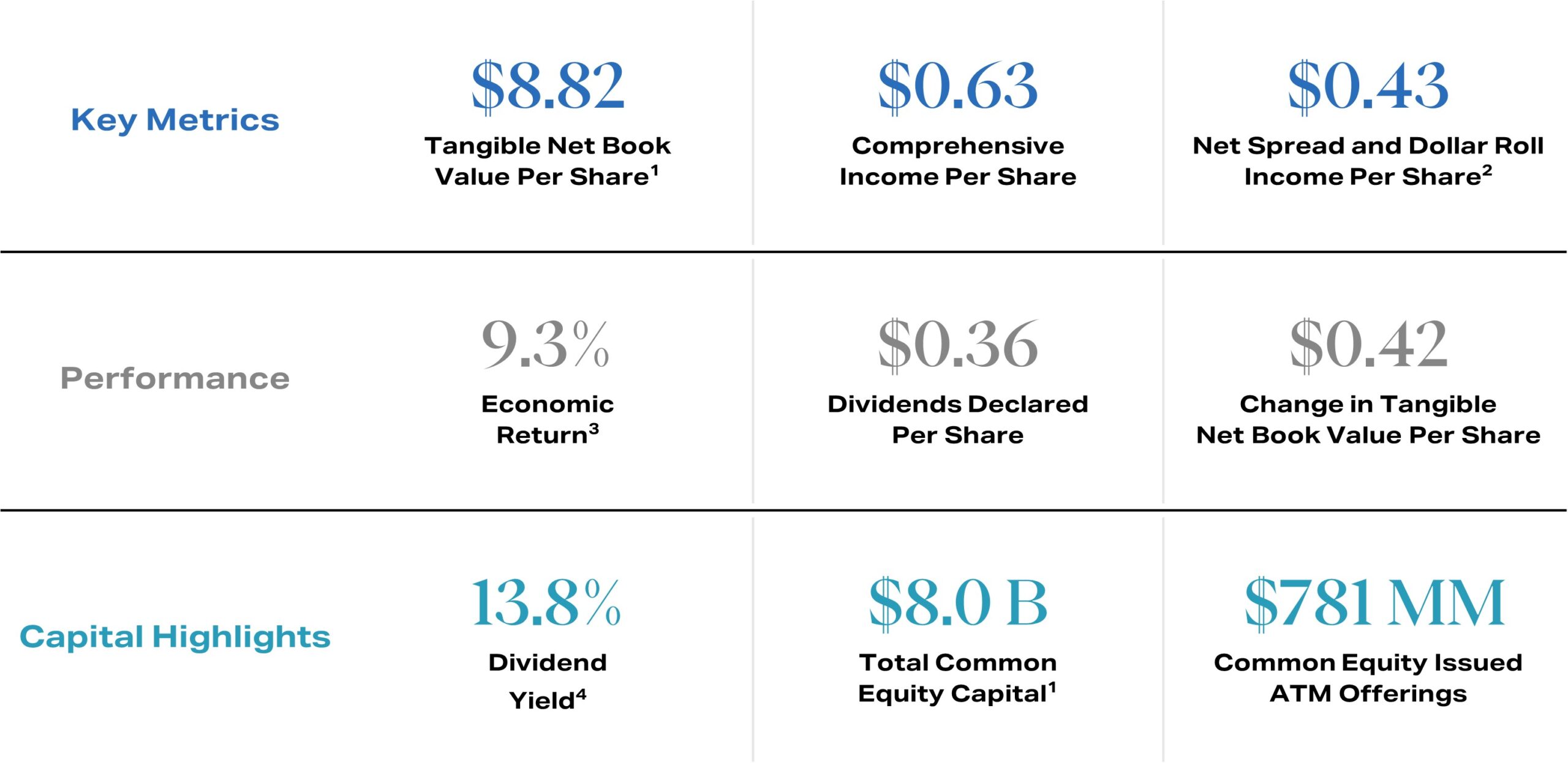

AGNC generated a very strong economic return of 9.3% in the third quarter, driven by significant book value growth and our compelling monthly dividend, which has remained stable at $0.12 per common share for 55 consecutive months. As a levered and hedged investor in Agency MBS, AGNC’s return opportunities are most favorable when Agency MBS spreads to benchmark rates are wide and stable and interest rates and monetary policy are less volatile. Our year-to-date performance – a 13.8% unannualized economic return – reflects both the benefits of our active portfolio management and the increasingly positive macroeconomic conditions.

The long-awaited monetary policy pivot by the Fed occurred at its September meeting with an initial 50 basis point rate cut. Consistent with historical experience, the Fed is expected to return the federal funds rate to a neutral level over the next 12 to 24 months, which would typically be accompanied by a steepening of the yield curve and growing demand for high quality fixed income instruments such as Agency MBS. Although the path of financial markets is never perfectly linear and periods of volatility are inevitable, the outlook for Agency MBS today is decidedly better than it was in 2022 and 2023 as a result of the positive direction of the broader economy, the accommodative Fed monetary policy stance, and the stability of Agency MBS spreads at these historically favorable levels.

Q3 2024 Highlights

management commentary highlights

Macroeconomic and Agency MBS Market Environment

Peter Federico | President and Chief Executive Officer

For the last several quarters, we have spoken about a promising and durable investment environment that we believed was unfolding for AGNC, an environment characterized by mortgage spreads that were materially wider than historical norms, declining interest rate volatility, and the emerging accommodative monetary policy stance by the Federal Reserve. In the third quarter, these positive trends became increasingly apparent, and as a result, investor optimism grew. Against this favorable fixed income investment backdrop, AGNC generated a very strong economic return of 9.3% in the third quarter, driven by solid book value growth and our compelling monthly dividend, which has now remained stable at $0.12 per common share for 55 consecutive months.

At its September meeting, the Fed began the process of recalibrating monetary policy with an initial rate cut that was larger than many expected. More important than the magnitude of the rate cut itself, the move marked the end of a very challenging three-year period of unprecedented monetary policy restraint. In addition, the Fed also communicated its intention to lower short-term rates to a neutral level over time. Consistent with this view, the September summary of economic projections showed the median federal funds rate declining by 250 basis points by the end of 2026. While the path to this neutral policy stance will undoubtedly depend on economic data, as Chair Powell explicitly stated, the direction of travel is now clear.

This significant transition in monetary policy marked a positive development for AGNC and for fixed income markets broadly speaking. In response to this improved monetary policy outlook, Treasury rates rallied across the yield curve, with short-term rates declining significantly more than long-term rates. To put the rate moves in perspective, the yield curve ended the quarter with a positive slope for the first time in two years. Agency MBS performance during the third quarter varied considerably by coupon and hedge composition, and our performance benefited from having a diversified mix of assets as well as a meaningful share of longer-term Treasury-based hedges.

From a macro perspective, there were a couple of important takeaways from the third quarter. First, the long-awaited Fed pivot occurred, and, consistent with historical experience, the Fed is expected to return the federal funds rate to a neutral level over the next 12 – 24 months. Typically, in such periods of monetary policy accommodation, the yield curve steepens, and the demand for high-quality fixed income instruments like Agency MBS grows. The other important takeaway from the quarter is that Agency MBS spreads remain in the same relatively narrow trading range that has now been in place for close to a year. This trading range compares very favorably to the highly volatile spread environment that existed while the Fed was aggressively tightening monetary policy.

As a levered and hedged investor in Agency MBS, AGNC’s return opportunities are most favorable when Agency MBS spreads to swap and Treasury rates are wide and stable and when interest rates and monetary policy are less volatile. We anticipated that this type of environment would eventually emerge once the Fed transitioned to an accommodative monetary policy stance, which it did at the September meeting. With Agency MBS spreads trading in a relatively narrow range this year, it follows that our common stock net asset value would also be relatively stable. That has been the case, with our net asset value per common share increasing a modest 1.4% over the first nine months of the year. Much more significantly, however, our economic return per common share, which includes the dividends we paid as well as the change in our net asset value, was 13.8% through the first nine months of the year. Similarly, our total stock return with dividends reinvested was 17.5% over the same period. This performance exemplifies AGNC’s ability to generate very attractive returns in environments where spreads are wide and stable.

Looking ahead, we believe the most likely scenario for Agency MBS spreads is that they remain in the current trading range. This view is predicated in part on our belief that the supply and demand dynamics for Agency MBS remain in reasonable balance. Given the recent modest decline in mortgage rates, it is possible that the supply of Agency MBS will increase somewhat over the intermediate term. On the demand side, however, accommodative monetary policy, a steeper yield curve, historically large money market mutual fund balances, and less onerous bank regulation indicate to us that the demand for high-quality fixed income assets is biased to increase as the Fed reduces short-term interest rates.

While the path of financial markets is never perfectly smooth, and periods of volatility are inevitable, the outlook for Agency MBS is decidedly better today than it was in 2022 and 2023 given the current economic outlook, the stance of the Fed, and our expectation that long-term interest rates and Agency MBS spreads will remain relatively stable.

Our Quarterly Financial Results

Bernie Bell | EVP and Chief Financial Officer

For the third quarter, AGNC had total comprehensive income of $0.63 per share. Economic return on tangible common equity was 9.3% for the quarter, comprised of $0.36 of dividends declared per common share and an increase in our tangible net book value of $0.42 per share, or 5%. As of late last week, our tangible net book value per common share was down about 3% for October, or about 3.5% after deducting our monthly dividend accrual.

Leverage decreased modestly for the quarter to 7.2x tangible equity as of quarter-end, from 7.4x as of Q2. Additionally, we concluded the quarter with unencumbered cash and Agency MBS of $6.2 billion, or 68% of our tangible equity, which was up from $5.3 billion, or 65% of tangible equity, as of June 30th.

The average projected life CPR for our portfolio at quarter-end increased 4% to 13.2%, consistent with the decline in interest rates, while the average coupon in our portfolio was largely unchanged at just over 5.0% as of September 30th. Actual CPRs for the quarter averaged 7.3%, up slightly from 7.1% for Q2.

Net spread and dollar roll income declined by $0.10 to $0.43 per common share for the quarter, driven by a reduction in our net interest rate spread, which narrowed by approximately 50 basis points to just above 220 basis points for the quarter. About half of the decline in our net interest spread was a result of $6.5 billion of very low cost pay-fixed swaps that matured during the quarter. We have no additional swaps scheduled to mature until the second quarter of next year. The other half of the decline was due to our decision to further reduce our swap-based hedges and increase our use of Treasury-based hedges, which are not captured in our reported net interest spread.

Lastly, in the third quarter, we issued $781 million of common equity through our at-the-market offering program. The significant increase in ATM issuance was consistent with the substantial price-to-book premium of our common stock throughout the quarter and drove material book value accretion for the benefit of our common stockholders. In addition, the positive investment environment provided a favorable backdrop for the deployment of this new capital.

Agency Portfolio Update and Performance

Chris Kuehl | EVP and Chief Investment Officer

Weaker economic data and increasingly dovish Fed rhetoric provided a constructive backdrop for risk assets and duration throughout the third quarter. The yield curve steepened dramatically, with 2-year and 10-year Treasury yields declining 112 and 62 basis points, respectively. Both MBS and corporate credit indices outperformed the Treasury benchmarks during the quarter; however, within MBS, performance was heavily influenced by coupon, hedge type, and tenor. Lower coupon MBS, which comprise the vast majority of the Bloomberg MBS Index, outperformed higher coupons in the third quarter, with 4.5% and lower coupons tightening 10 – 15 basis points, while 5.0% and higher coupons ranged from slightly tighter to modestly wider.

The outperformance of lower coupon MBS was driven by favorable technicals, as fixed income bond fund inflows continued to increase at an average weekly pace year-to-date of $8.5 billion, roughly double the pace of last year. These funds are largely index-based and, as such, drove demand for lower coupon MBS. In contrast, the decline in primary mortgage rates, combined with the tail-end of elevated seasonal housing activity, led to an increase in supply and the relative underperformance of production coupon MBS. Notably, Agency MBS spread volatility has been considerably lower in 2024, with par coupon spreads to a blend of 5- and 10-year Treasury yields trading in a range of 40 basis points. This compares favorably to 2023 and 2022, when par coupon spreads traded in a range of 75 and 108 basis points, respectively.

During the third quarter, we added about $5 billion in Agency MBS, and as a result, our investment portfolio increased to $72.1 billion as of September 30th. In terms of portfolio composition, we added approximately $6 billion in specified pools during the quarter, most of which were in low pay-up categories, while our TBA position declined, consistent with conventional rolls trading at relatively weak implied funding levels. Our Ginnie Mae TBA position in aggregate was largely unchanged as of September 30th, as valuations remained attractive and roll-implied financing continued to offer an advantage versus repo funding.

Hedge positioning was also a material driver of performance during the third quarter given a combination of yield curve steepening and swap spread tightening. As a result, MBS hedged with longer-tenor U.S. Treasury-based instruments generated significantly better total returns. During the third quarter, we decreased our swap-based hedges and increased our allocation to Treasury-based hedges. Importantly, we also continued to increase our use of longer-term hedges given the shift in monetary policy and our expectations for further yield curve steepening. Consistent with this shift toward longer-term hedges, our overall hedge ratio declined to 72%. We believe longer-term Treasury hedges give us additional protection against the challenges posed by the growing U.S. government debt and ongoing budget deficits.

Non-Agency Portfolio Update and Performance

Aaron Pas | SVP, Non-Agency Investments

In early August, as market expectations shifted toward faster rate cuts, credit spreads initially widened; by the end of the quarter, however, broad-based risk-on sentiment pushed macro markets higher. As a result, credit spreads generally ended the quarter unchanged to somewhat tighter. In Q3, the synthetic investment grade index was close to unchanged, while the high yield index tightened by about 15 basis points. On the cash bond side, the Bloomberg IG Index narrowed by 5 basis points, and, subsequent to quarter-end, has tightened another 8 basis points. Last week, this index closed through the tightest levels seen during the Covid quantitative easing period and reached the tightest valuations in the post-Great Financial Crisis era.

As we have mentioned before, credit fundamentals continue to show a divided consumer base. Lower-income households continue to face pressure, but we have yet to see significant signs of distress. Our non-Agency securities portfolio ended the quarter at $890 million, down roughly 5% from the previous quarter, with the composition of our holdings mostly unchanged. The reduction in the portfolio was due to our participation in GSE tender offers for credit risk transfer securities. Lastly, the funding environment for non-Agency securities remained stable and historically attractive.

Important Disclosures

This commentary includes excerpts from AGNC Investment Corp.’s (“AGNC”) Q3 2024 earnings call. Click here to listen to the full webcast and access the earnings release and presentation.

Per share amounts are per share of common stock, unless otherwise indicated. Income and loss per share amounts are per diluted common share, unless otherwise indicated.

1. As of September 30, 2024. Tangible Net Book Value Per Share and Total Common Equity Capital are net of the preferred stock liquidation preference. Tangible Net Book Value Per Share excludes goodwill.

2. Net Spread and Dollar Roll Income Per Share (f/k/a Net Spread and Dollar Roll Income, Excluding “Catch-Up” Amortization, Per Share) represents a non-GAAP measure. Refer to our Q3 2024 Stockholder Presentation for a reconciliation and further discussion of non-GAAP measures.

3. Economic Return represents the sum of the change in tangible net book value per common share and dividends declared on common stock during the period over the beginning tangible net book value per common share.

4. Dividend yield as of September 30, 2024.

These materials contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are based on estimates, projections, beliefs and assumptions of management of AGNC at the time of such statements and are not guarantees of future performance. Forward-looking statements involve risks and uncertainties in predicting future results and conditions. Actual results could differ materially from those projected in these forward-looking statements or from our historic performance due to a variety of important factors, including, without limitation, changes in monetary policy and other factors that affect interest rates, MBS spreads to benchmark interest rates, the forward yield curve, or prepayment rates; the availability and terms of financing; changes in the market value of AGNC’s assets; general economic or geopolitical conditions; liquidity and other conditions in the market for Agency securities and other financial markets; and legislative and regulatory changes that could adversely affect the business of AGNC. Certain factors that could cause actual results to differ materially from those contained in the forward-looking statements are included in AGNC’s periodic reports filed with the SEC and available on the SEC’s website at www.sec.gov. AGNC disclaims any obligation to update or revise any forward-looking statements based on the occurrence of future events, the receipt of new information, or otherwise.

We use our website (www.AGNC.com) and AGNC’s LinkedIn and X accounts to distribute information about the Company. Investors should monitor these channels in addition to our press releases, SEC filings, and public conference calls and webcasts, as information posted through them may be deemed material. Stockholders and other interested parties may sign up to receive AGNC’s news, perspectives, and other types of email alerts by clicking the Subscribe link below.