THE EARNINGS Extract

Q4 and full year 2024 EARNINGS COMMENTARy

JANUARY 28, 2025

Entering 2025, we continue to have a very positive outlook for Agency MBS, supported by the increasingly favorable environment that emerged in 2024. The Federal Reserve finally shifted its restrictive monetary policy stance and began the process of returning short term rates to a neutral level. With declining inflationary pressures and accommodative monetary policy, interest rate volatility eased during the year, and the yield curve steepened after being inverted for the second longest episode on record. In addition, with primary mortgage rates again near 7%, the supply of Agency MBS should continue to be limited and reasonably well-aligned with investor demand. Lastly, and perhaps most importantly to our business, Agency MBS spreads to benchmark rates remain in a

well-defined range and offer levered and unlevered investors very attractive return opportunities.

Against this improved investment backdrop, AGNC generated a positive economic return of 13.2% in 2024, driven by our compelling monthly dividend. Our 2024 performance provides investors a good example of AGNC’s ability to generate strong investment returns in environments in which Agency MBS spreads are wide and stable, and we anticipate that this favorable environment for Agency MBS will persist. Moreover, AGNC provides investors with access to this unique and attractively valued fixed income asset class on a levered basis through an investment vehicle that has produced best-in-class returns since inception.

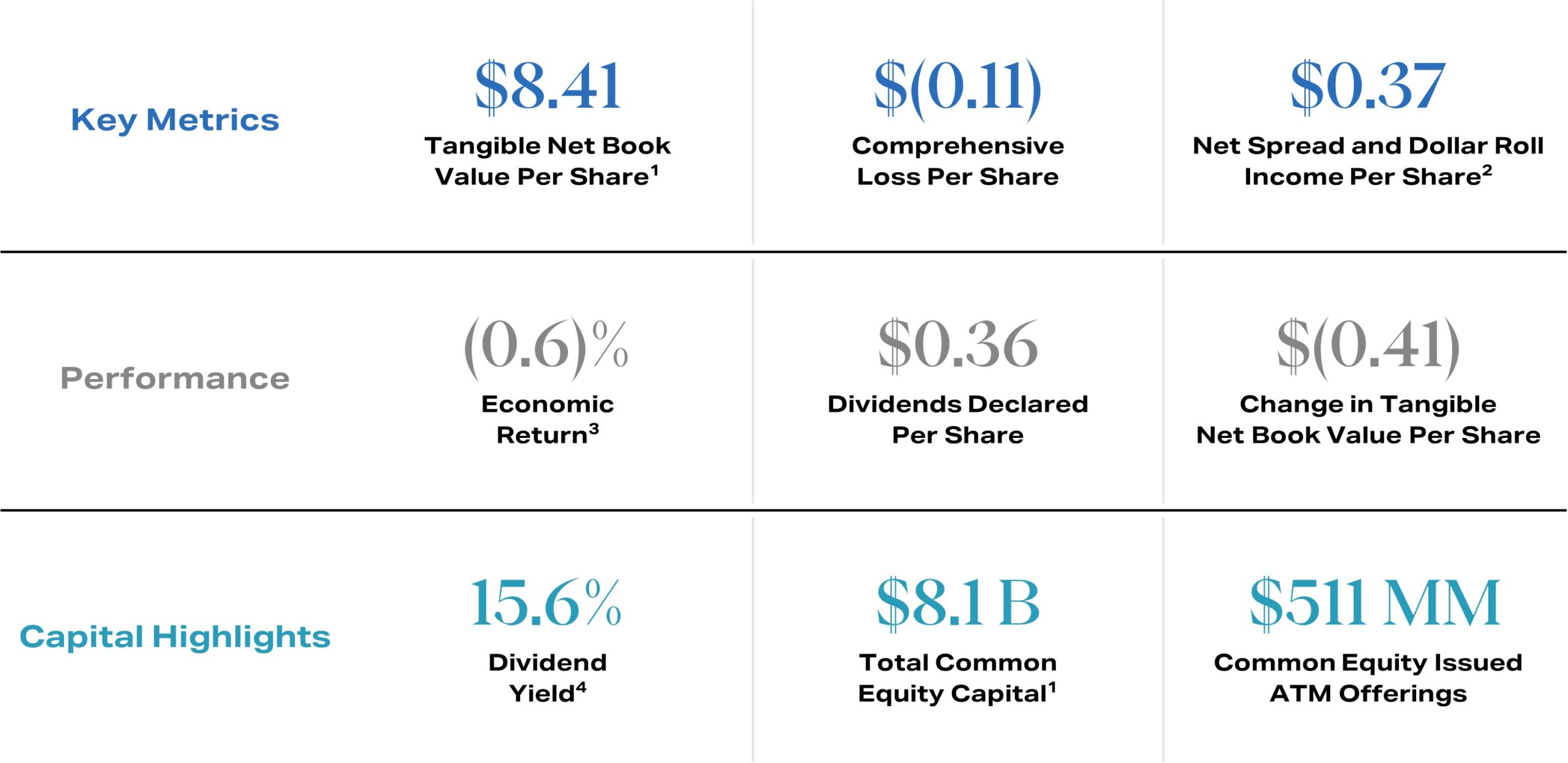

Q4 2024 Highlights

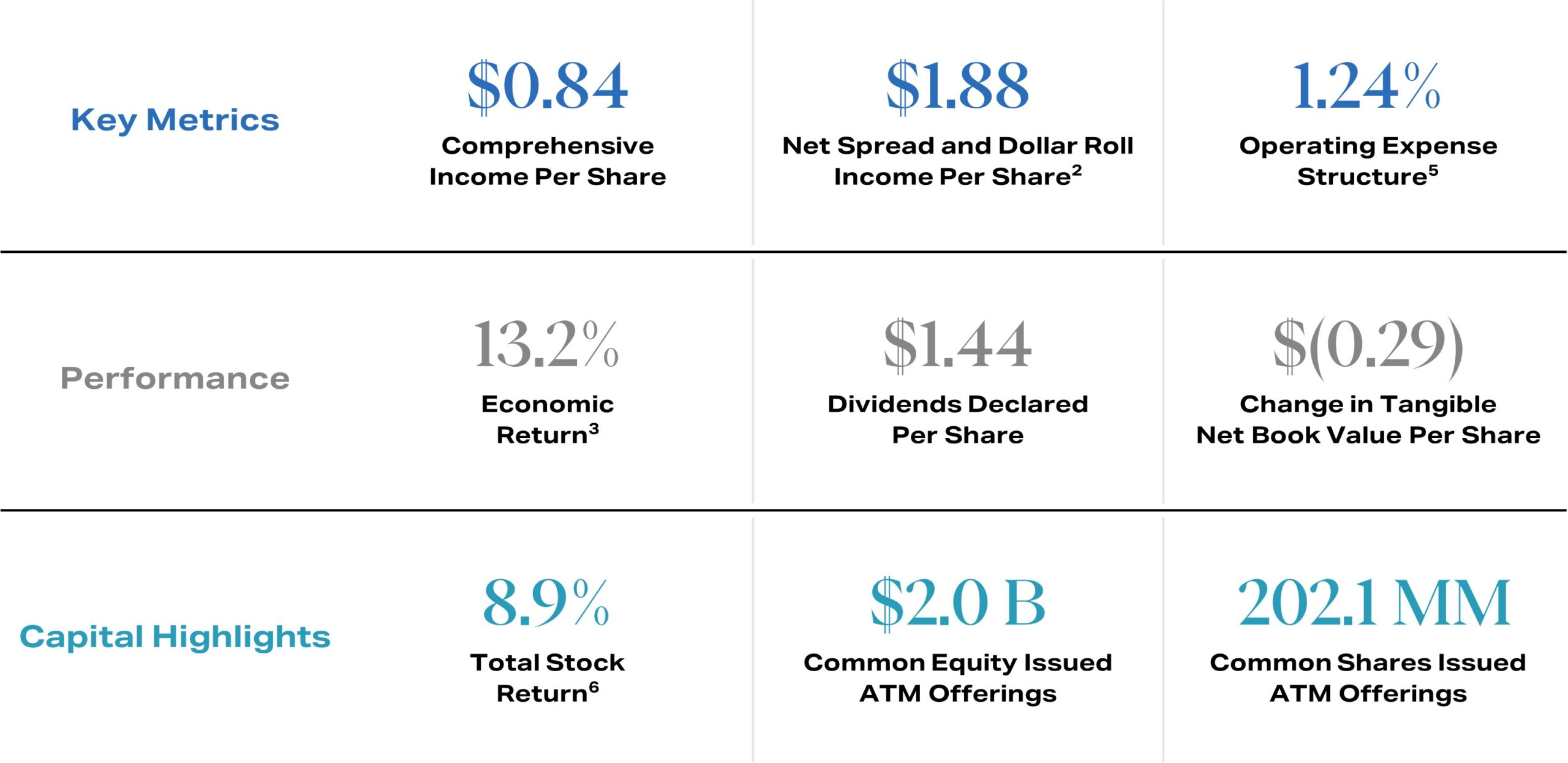

full year 2024 Highlights

management commentary highlights

Macroeconomic and Agency MBS Market Environment

Peter Federico | President and Chief Executive Officer

The favorable investment themes that emerged in 2024 continue to support our positive outlook for Agency mortgage-backed securities. Last year, the Fed shifted its restrictive monetary policy stance and began the process of returning short term rates to a neutral level. Declining inflationary pressures and accommodative monetary policy caused interest rate volatility to ease and the yield curve to steepen after being inverted for more than two years. As we begin 2025, the supply and demand outlook for Agency MBS appears to be well-balanced. In addition, and most important to our business, we expect Agency MBS spreads to benchmark rates to remain in the same well-defined trading range, thus providing levered and unlevered investors very attractive return opportunities.

Against this improved investment backdrop, AGNC generated a positive economic return of 13.2% in 2024, driven by our compelling monthly dividend. Our performance in 2024 demonstrates AGNC’s ability to generate strong investment returns in environments where spreads are wide and stable.

Since September, the Fed lowered short term rates by 100 basis points as it recalibrated monetary policy. While the path of monetary policy continues to move toward a neutral level, strong economic data late in the quarter extended the timeline, as evidenced by the Fed’s December Summary of Economic Projections, which showed fewer rate cuts in 2025 and 2026 relative to the September release. The U.S. presidential election also raised concerns about fiscal policy, deficit spending, and the magnitude of future Treasury issuance. This elevated monetary and fiscal policy uncertainty overshadowed the positive investment sentiment that characterized the first three quarters of the year. Together, the sharp increase in interest rates and modestly wider Agency MBS spreads drove our slightly negative economic return for the fourth quarter.

As we begin 2025, our outlook for Agency mortgage-backed securities continues to be very favorable. Despite significant monetary policy easing, longer term interest rates have increased meaningfully, and the 30-year primary mortgage rate is once again close to 7%. At this rate level, the supply of Agency MBS in 2025 should be similar to what we experienced in 2024 and reasonably well-aligned with investor demand. Greater bank demand is also possible given the likelihood of less onerous regulation.

Lastly, Agency mortgage-backed securities offer investors unique diversification benefits and an attractive return profile, but they are difficult for many investors to access. AGNC’s common stock provides investors an easy way to invest in this unique fixed income asset class on a levered and hedged basis, which is otherwise only available to institutional investors with sophisticated trading desks.

In summary, the current monetary policy stance of the Fed provides a positive underlying investment foundation for high-quality fixed income instruments like Agency mortgage-backed securities, particularly at current valuation levels. The supply and demand outlook for Agency MBS appears to be well-balanced, with upside demand possible, and we expect Agency MBS spreads to remain in their current attractive trading range. Collectively, these positive dynamics create a favorable investment backdrop for AGNC in 2025.

Our Quarterly Financial Results

Bernie Bell | EVP and Chief Financial Officer

For the fourth quarter, AGNC had a comprehensive loss of $(0.11) per common share. Economic return on tangible common equity was (0.6)% for the quarter, comprised of $0.36 of dividends declared per common share and a $(0.41) decline in our tangible net book value per common share, resulting from higher interest rates and modestly wider spreads for the quarter.

Our full year economic return was a positive 13.2%, driven by our monthly dividend totaling $1.44 per common share and a $(0.29) decline in tangible net book value per common share. As of late last week, our tangible net book value per common share was up about 1% for January, or about unchanged after deducting our monthly dividend accrual.

In the fourth quarter, we opportunistically raised $511 million of common stock through our at-the-market offering program at a considerable premium to tangible net book value. This brought our total issuance of accretive common equity for the year to approximately $2 billion, delivering meaningful book value accretion to our common stockholders.

Our average and ending leverage for the fourth quarter was unchanged at 7.2x tangible equity, as compared to the third quarter. Additionally, we concluded the quarter with unencumbered cash and Agency MBS of $6.1 billion, or 66% of our tangible equity.

The average projected life CPR for our portfolio at quarter-end decreased to 7.7% from 13.2% at the end of the third quarter, consistent with higher interest rates. Actual CPRs for the quarter averaged 9.6%, up from 7.3% in the third quarter.

Lastly, net spread and dollar roll income declined by $0.06 to $0.37 per common share in the fourth quarter due to a 30 basis point narrowing of our net interest rate spread to just above 190 basis points. The decline in our net spread income and net interest margin was driven by a slightly higher pay rate on our interest rate swap portfolio, timing differences between the receive rate on our interest rate swaps and our repo costs, and lastly, our shift toward a greater proportion of Treasury-based hedges, which are not included in our reported net interest spread or net spread income. To enhance transparency, we have included additional details on our Treasury position and associated carry components in our investor presentation and earnings release. We estimate that the carry on our Treasury hedges was $0.04 per share for the fourth quarter.

Investment Portfolio Update and Performance

Chris Kuehl | EVP and Chief Investment Officer

The fixed income investment landscape in 2024 was shaped by economic data and evolving Fed policy expectations, leading to significant interest rate volatility. The fourth quarter was no exception, with strong economic data leading to renewed hawkish rhetoric from the Fed and the paring back of future rate cuts from market pricing.

This evolving monetary policy outlook, combined with a general risk-off sentiment ahead of the U.S. presidential election, caused Agency MBS to underperform swap and Treasury hedges, particularly in the month of October. Following the election, however, Agency MBS spreads recovered somewhat, with the 30-year par coupon spread to a blend of 5- and 10-year Treasury hedges ending the quarter six basis points wider. Performance across the coupon stack was mixed, with higher coupon MBS performing the best, while 4.5% and lower coupons generally experienced the greatest underperformance.

During the fourth quarter, we added approximately $2 billion in Agency MBS, and, as a result, our investment portfolio totaled $73.3 billion as of December 31, 2024. Our asset growth was concentrated later in the quarter at attractive spreads, and we have continued to add to the investment portfolio in the month of January. In terms of portfolio composition, we continued to move up in coupon, reducing holdings in 4.5% and lower coupons by roughly $6 billion, while adding approximately $8 billion in 5.0% and higher coupons. As has been the case for several quarters now, our TBA position consisted primarily of Ginnie Mae TBAs, as valuations and roll-implied financing levels remained attractive. Our non-Agency securities portfolio ended the quarter at $884 million, down slightly from the previous quarter, with the composition of our holdings mostly unchanged.

Given the meaningful back-up in interest rates, associated asset duration extension, and portfolio growth, we added close to $12 billion in longer term, mostly Treasury-based hedges during the quarter. As a result, our hedge ratio to funding liabilities increased materially to 91%, and Treasury-based hedges as percentage of our hedge portfolio represented 53% on a dollar-duration basis as of quarter-end. However, with longer term Treasury rates and swap spreads beginning to show signs of stabilization, our allocation to swap-based hedges will likely increase over the coming quarters.

Our Perspective on GSE Reform

Peter Federico | President and Chief Executive Officer

The outcome of the U.S. presidential election has clearly reignited the market’s interest in the GSE (Fannie Mae and Freddie Mac) conservatorships and the nature of the government’s involvement in the U.S. housing finance system. A number of proposals and opinion pieces recently have advocated for various outcomes, ranging from ending the GSE conservatorships to maintaining the status quo. Importantly, there appears to be a growing consensus that any change should be done in a way that preserves the current functionality of the conventional mortgage market, avoids disrupting the domestic real estate market, and ensures that housing affordability does not decline further. To that end, some key policy makers have already signaled a desire to pursue any change in a careful, deliberate, and transparent way.

The $7.5 trillion Agency mortgage-backed securities market is the cornerstone of this country’s $14 trillion housing finance system, a system that is the envy of the world, by providing the uninterrupted availability of the 30-year prepayable mortgage at uniform rates across the nation and throughout market cycles. The size of the Agency MBS market, the liquidity of and ability to finance these instruments, their use as a monetary policy tool, and the existence of the TBA market – as well as the important role it plays for mortgage originators and servicers – all exist today because of the government’s ongoing involvement in this market and because of the actions that the government, and the Fed, have taken during times of stress.

Moreover, the Agency MBS market is critical to facilitating homeownership, achieving the many societal benefits that accompany it, and doing so in a manner that is fair and equitable. We believe that preserving these attributes and avoiding a disruptive outcome for the housing finance system requires the ongoing involvement of the U.S. Government.

Changing the structure of the GSEs hastily – without thoughtful consideration of the many complexities and interconnectedness of the current system – would be unnecessarily disruptive and very harmful to housing affordability. That said, implementing change in a way that preserves the many highly desirable aspects of the current system, provides clarity regarding the form of the government’s ongoing involvement, and protects taxpayer interests could be a very positive development for the Agency MBS market.

Important Disclosures

This commentary includes excerpts from AGNC Investment Corp.’s (“AGNC”) Q4 2024 earnings call. Click here to listen to the full webcast and access the earnings release and presentation.

Per share amounts are per share of common stock, unless otherwise indicated. Income and loss per share amounts are per diluted common share, unless otherwise indicated.

1. As of December 31, 2024. Tangible Net Book Value Per Share and Total Common Equity Capital are net of the preferred stock liquidation preference. Tangible Net Book Value Per Share excludes goodwill.

2. Net Spread and Dollar Roll Income Per Share (f/k/a Net Spread and Dollar Roll Income, Excluding “Catch-Up” Amortization, Per Share) represents a non-GAAP measure. Refer to our Q4 2024 Stockholder Presentation for a reconciliation and further discussion of non-GAAP measures.

3. Economic Return represents the sum of the change in tangible net book value per common share and dividends declared on common stock during the period over the beginning tangible net book value per common share.

4. Dividend Yield as of December 31, 2024.

5. Operating Expense Structure calculated as total operating expense divided by average stockholders’ equity for the period. Average stockholders’ equity calculated as the average month-ended stockholders’ equity during the period.

6. Total Stock Return includes common stock price appreciation and dividend reinvestment. Dividends assumed to be reinvested at the closing price on the ex-dividend date. Source: Bloomberg.

These materials contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are based on estimates, projections, beliefs and assumptions of management of AGNC at the time of such statements and are not guarantees of future performance. Forward-looking statements involve risks and uncertainties in predicting future results and conditions. Actual results could differ materially from those projected in these forward-looking statements or from our historic performance due to a variety of important factors, including, without limitation, changes in monetary policy and other factors that affect interest rates, MBS spreads to benchmark interest rates, the forward yield curve, or prepayment rates; the availability and terms of financing; changes in the market value of AGNC’s assets; general economic or geopolitical conditions; liquidity and other conditions in the market for Agency securities and other financial markets; and legislative and regulatory changes that could adversely affect the business of AGNC. Certain factors that could cause actual results to differ materially from those contained in the forward-looking statements are included in AGNC’s periodic reports filed with the SEC and available on the SEC’s website at www.sec.gov. AGNC disclaims any obligation to update or revise any forward-looking statements based on the occurrence of future events, the receipt of new information, or otherwise.

We use our website (www.AGNC.com) and AGNC’s LinkedIn and X accounts to distribute information about the Company. Investors should monitor these channels in addition to our press releases, SEC filings, and public conference calls and webcasts, as information posted through them may be deemed material. Stockholders and other interested parties may sign up to receive AGNC’s news, perspectives, and other types of email alerts by clicking the Subscribe link below.