monthly macro monitor

key trends for the agency mbs investor

august 2024

- In August, the Federal Reserve held its annual economic symposium in Jackson Hole. Chair Powell conveyed a very dovish message during his keynote speech, remarking that “the time has come for policy to adjust” and “the direction of travel is clear,” though the timing and pace of rate cuts will continue to be data dependent.

- Consistent with the Fed’s heightened attentiveness to employment that was signaled at the July FOMC meeting, Chair Powell also noted that “the cooling in labor market conditions is unmistakable” and that the Fed does “not seek or welcome further cooling in labor market conditions.”

- These comments came just days after the Bureau of Labor Statistics revised nonfarm payroll growth down by 818,000 jobs, or almost 30%, from previously reported levels for the trailing 12 months ended March 2024.

- With the Fed now giving equal focus to both sides of its dual mandate – price stability and maximum employment – the market repriced to the expectation of 100 basis points of rate cuts by year-end.

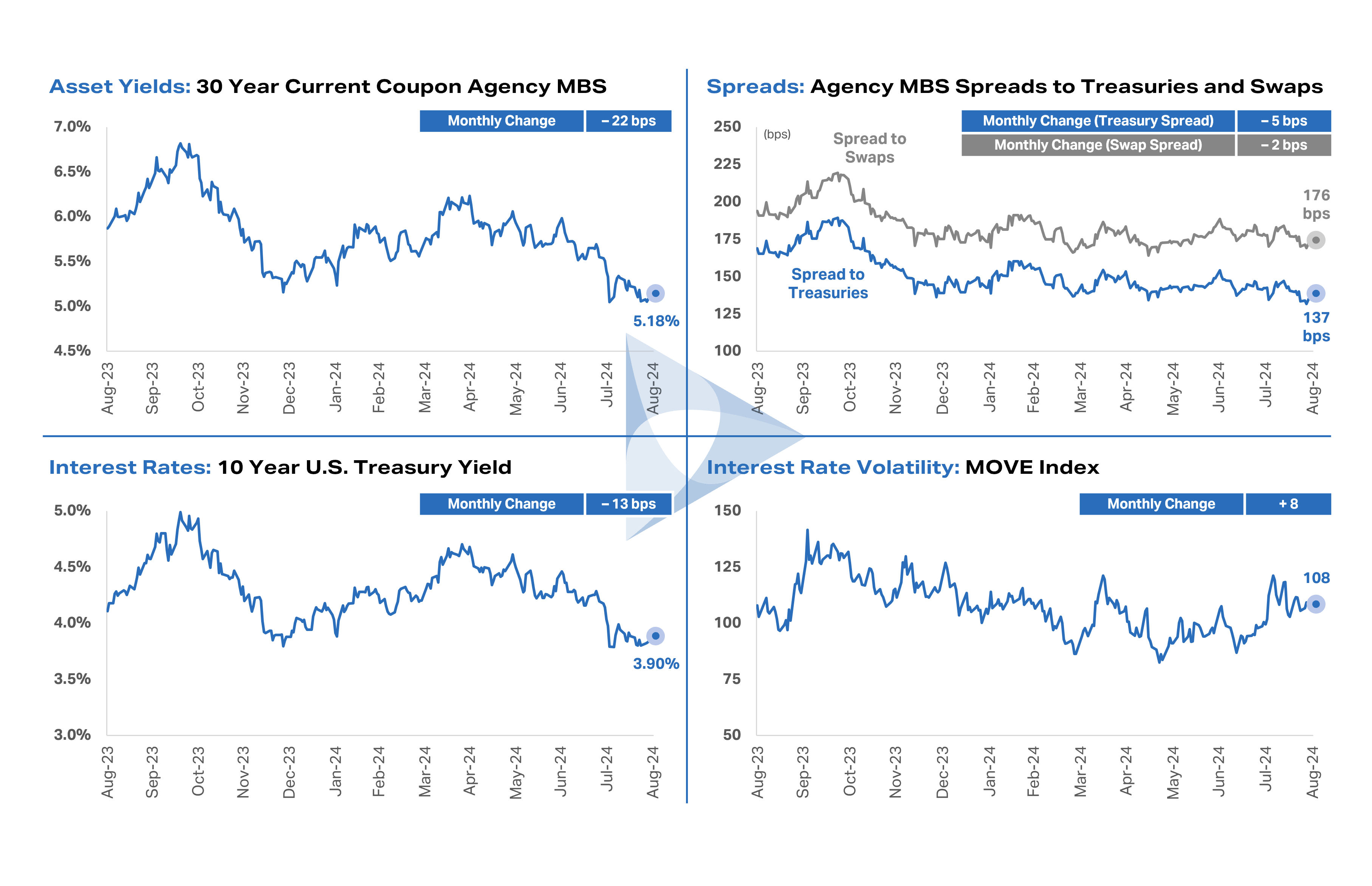

- Against this backdrop, benchmark interest rates declined in August, the yield curve steepened, and current coupon Agency MBS spreads to blended 5- and 10-year swap and Treasury rates tightened modestly.

Key Rate and Spread trends

Important Disclosures

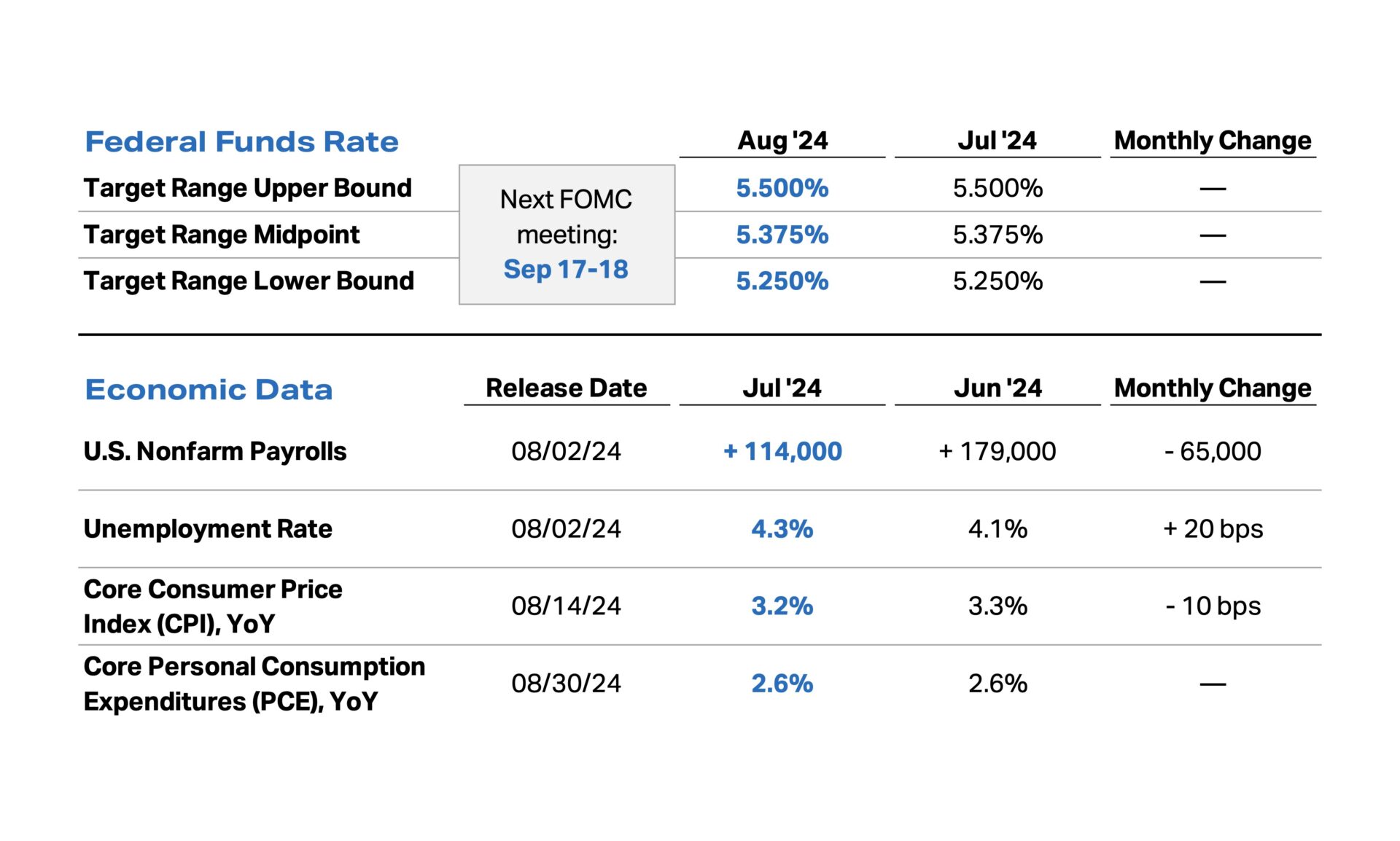

Federal funds rate data last updated August 31, 2024. Source: Federal Reserve.

Economic data last updated August 31, 2024. Core CPI and Core PCE exclude food and energy. Source: Bureau of Labor Statistics and Bureau of Economic Analysis.

Current coupon Agency MBS reflects the 30-year current coupon Agency MBS yield. Agency MBS spread to U.S. Treasuries and Agency MBS spread to swaps reflect the 30-year current coupon Agency MBS yield spread to a 50/50 average of 5- and 10-year U.S. Treasury yields and a 50/50 average of 5- and 10-year SOFR OIS swaps, respectively. MOVE Index reflects the ICE BofA Move Index. Each chart is shown over the trailing 12 months ended August 31, 2024, and each monthly change reflects the difference between August 2024 month-end data and July 2024 month-end data. Source: Bloomberg.

Data and commentary is provided for information purposes only and should not be construed as investment advice.

Investment in AGNC Investment Corp. (“AGNC”) involves risks and uncertainties that may cause future performance to vary from historical results. Please refer to our annual and quarterly reports on file with the SEC and available on our website or at www.sec.gov for more information about AGNC, including material risks and other factors that may affect future performance. Stockholders and other interested parties may sign up to receive AGNC’s news, perspectives, and other types of email alerts by clicking the Subscribe link below.