monthly macro monitor

key trends for the agency mbs investor

february 2025

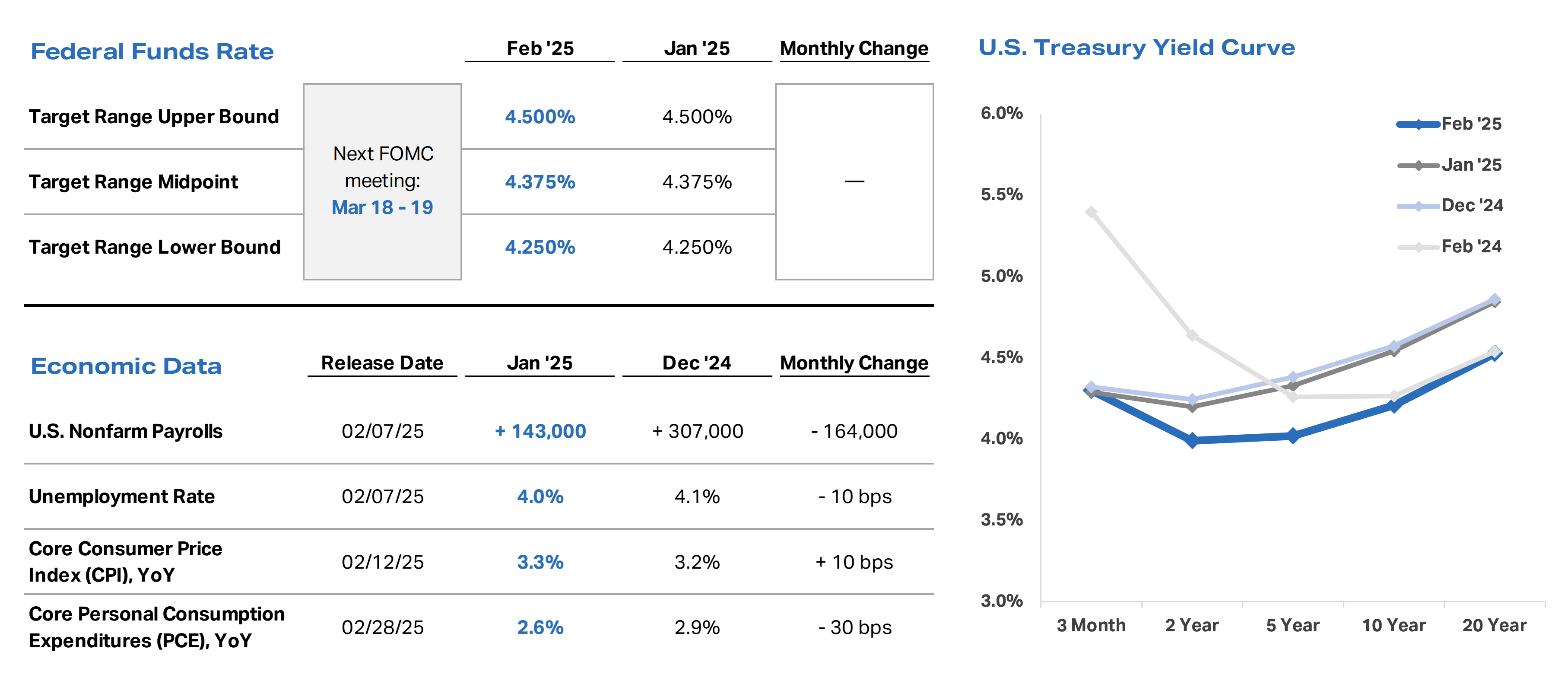

- January inflation measures released during the month were mixed. Core CPI exceeded consensus estimates, while Core PCE was in-line with estimates and reached its lowest level since June 2024.

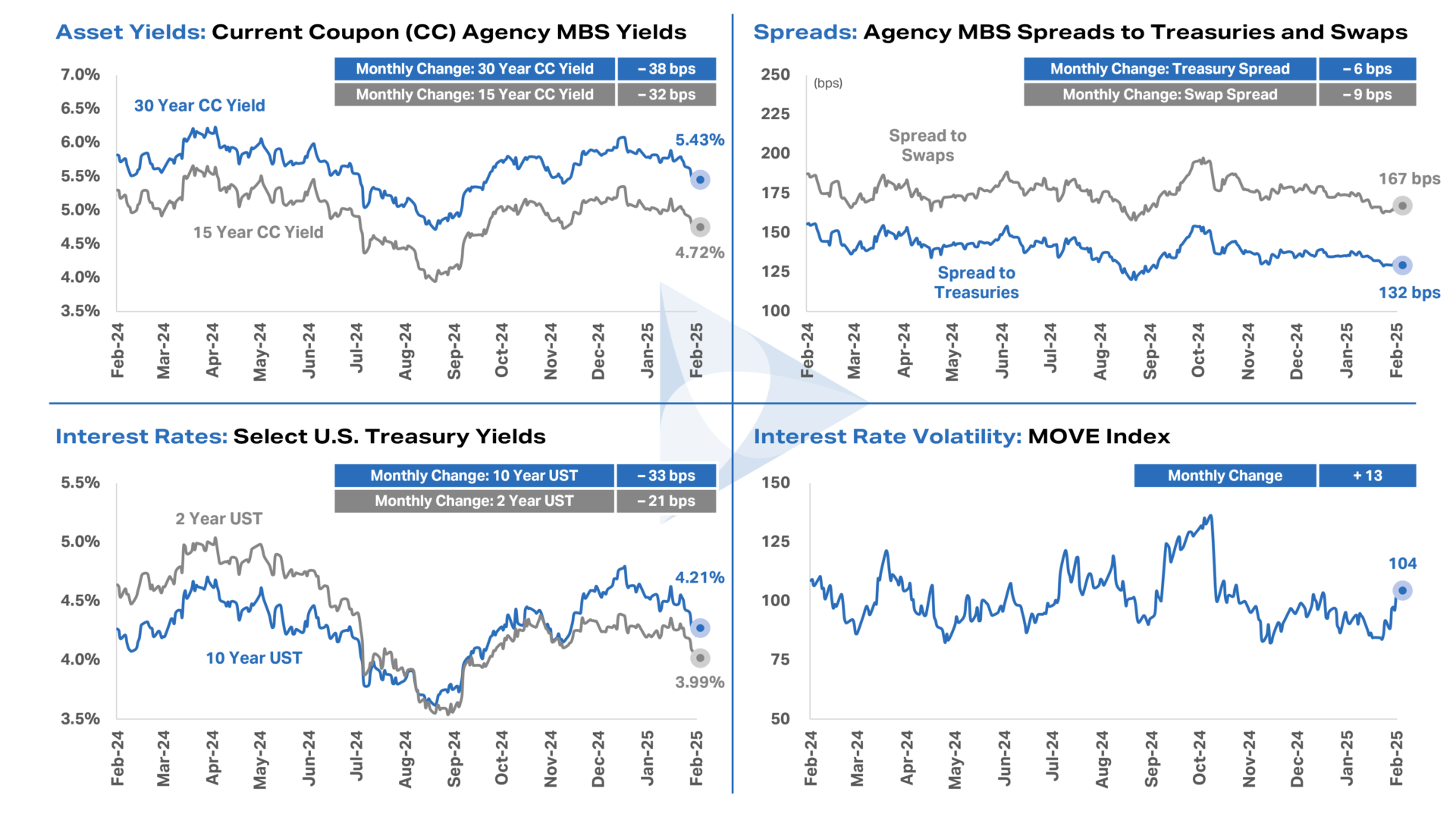

- The yield curve flattened modestly in February, and interest rate volatility increased toward the end of the month against increased geopolitical uncertainty and the potential near-term implementation of tariffs by the new administration.

- With near-term inflationary uncertainty and somewhat slower-than-expected job growth as indicated by the January nonfarm payrolls report, we expect the Fed to reiterate its wait-and-see and data-dependent approach to monetary policy at its March meeting.

- Agency MBS spreads to benchmark rates were relatively stable during the month and continued to trade within the relatively narrow and advantageous range that has emerged over the last year.

Key Rate and Spread trends

Important Disclosures

Federal funds rate data last updated February 28, 2025. Source: Federal Reserve.

Economic data last updated February 28, 2025. Core CPI and Core PCE exclude food and energy. Source: Bureau of Labor Statistics and Bureau of Economic Analysis.

U.S. Treasury yield curve reflects month-end Treasury yields for each tenor and month shown. Source: Bloomberg.

Agency MBS spread to U.S. Treasuries and Agency MBS spread to swaps reflect the 30-year current coupon Agency MBS yield spread to a 50/50 average of 5- and 10-year U.S. Treasury yields and a 50/50 average of 5- and 10-year SOFR OIS swaps, respectively. MOVE Index reflects the ICE BofA Move Index. Each chart is shown over the trailing 12 months ended February 28, 2025, and each monthly change reflects the difference between February 2025 month-end data and January 2025 month-end data. Source: Bloomberg.

Data and commentary is provided for information purposes only and should not be construed as investment advice.

Investment in AGNC Investment Corp. (“AGNC”) involves risks and uncertainties that may cause future performance to vary from historical results. Please refer to our annual and quarterly reports on file with the SEC and available on our website or at www.sec.gov for more information about AGNC, including material risks and other factors that may affect future performance. Stockholders and other interested parties may sign up to receive AGNC’s news, perspectives, and other types of email alerts by clicking the Subscribe link below.