THE EARNINGS Extract

Q2 2024 EARNINGS COMMENTARy

JULY 23, 2024

The strong fixed income sector momentum that began in the fourth quarter of 2023 abated in the second quarter, as the Federal Reserve (the Fed) and market participants analyzed economic data for indications that the economy was slowing and inflation moderating. In aggregate, consumer spending and confidence weakened, the labor market moved into better balance, and, most importantly, inflation measures resumed a downward trajectory toward the Fed’s long run target. Despite the softening in these economic measures throughout the quarter, the Fed remained steadfast in its hawkish monetary policy stance. As a result, intra-quarter volatility increased, interest rates edged higher, and Agency MBS spreads to benchmark rates widened.

Nevertheless, the longer-term outlook for Agency MBS remains very favorable and continues to provide reason for optimism. Agency MBS spreads have continued to trade in a range that is conducive to favorable long-term risk-adjusted returns for levered investors such as AGNC. At these levels, Agency MBS provide meaningful incremental yield relative to both U.S. Treasuries and investment grade corporate debt, which we anticipate will continue to drive demand for Agency MBS. Given persistent housing affordability challenges and historically slow prepayment speeds, the net supply of Agency MBS over the intermediate term will likely remain below previous projections. In light of the favorable supply-demand dynamic for Agency MBS and improving monetary policy outlook, we continue to be very optimistic about both the current returns and future prospects for our business.

Q2 2024 Highlights

management commentary highlights

Macroeconomic and Agency MBS Market Environment

Peter Federico | President and Chief Executive Officer

The strong fixed income momentum that began in the fourth quarter of 2023 abated in the second quarter, as the Federal Reserve and market participants looked for indications that the economy was slowing and inflation moderating. On balance, the data showed that consumer spending and confidence were weakening, the labor market was moving into better balance, and most importantly, inflation measures were trending toward the Fed’s long run target. From a monetary policy perspective, this was a welcome development. Nevertheless, the Federal Reserve was unwilling to adopt a more accommodative monetary policy stance. Against the backdrop of diverging economic and monetary policy outlooks, fixed income markets became more cautious and intra-quarter volatility increased. In aggregate, interest rates edged higher and Agency mortgage-backed security spreads widened, driving AGNC’s negative economic return of just under 1%.

In the current environment, each economic release carries elevated importance, as the Fed seeks greater confidence before easing monetary policy conditions. This was clearly the case in the second quarter, with interest rates and spreads reacting sharply to each labor and inflation report. The 10-year Treasury, for example, ended the quarter just 20 basis points higher, but experienced several sharp selloff and rally episodes during the quarter that drove a cumulative daily yield change of more than 300 basis points.

For Agency MBS, the second quarter was a push and pull between evolving supply and demand dynamics. On the demand side, bank and foreign demand moderated in the second quarter, while demand from bond funds remained steady, but limited, given an already overweight position. The modest weakening of MBS demand and associated widening of mortgage spreads was also somewhat expected, as spreads ended the first quarter at the tighter end of the recent trading range.

On the supply side, favorable seasonal dynamics often lead to a notable uptick in mortgage supply in the second quarter of the year. This was indeed the case this year with $52 billion in supply in the second quarter, double the pace of the first quarter; supply was especially heavy during the last week of the quarter. As a result, Agency MBS spreads to Treasuries widened five to 10 basis points across the coupon stack, with a good portion of that spread widening occurring over the last several days of the quarter. Production coupons, namely 5.5’s and 6’s, experienced the greatest spread widening given the uptick in supply.

Importantly, however, Agency MBS continue to trade in the same, relatively narrow, spread range that has emerged over the last nine months. For the current coupon, that trading range has been 140 to 160 basis points to a blend of 5- and 10-year Treasury hedges. Using a similar combination of swap hedges, that range has been 170 to 190 basis points. Spreads at quarter-end to Treasuries and swaps were 150 and 180 basis points, respectively, right in the middle of the recent range. We continue to view this range-bound trading behavior as a very positive development for Agency MBS.

Since quarter-end, economic data has continued to be supportive of the Fed moving toward a more accommodative monetary policy stance. That shift will likely occur over the next several months and should be viewed as the beginning of a new, more favorable monetary policy cycle. To this point, in its most recent Summary of Economic Projections, the Fed’s short-term rate forecast showed a total of nine rate cuts over the next two years. As at least some of these rate cuts become a reality, the risk of meaningfully higher interest rates will decline, interest rate volatility will decline, and the yield curve will steepen. These will all be positive developments for the Agency MBS market specifically and for fixed income more broadly.

Lastly, the longer-term fundamentals for Agency MBS remain very favorable and continue to give us reason for optimism. In light of persistent affordability challenges and historically slow prepayment speeds, the net supply of Agency MBS over the intermediate term will likely remain below previous expectations. At the same time, from a demand perspective, Agency MBS provide investors with a meaningful amount of incremental yield relative to both U.S. Treasuries and investment grade corporate debt at current valuation levels. For these reasons, we continue to be very optimistic about both the current returns and the future prospects for our business.

Our Quarterly Financial Results

Bernie Bell | EVP and Chief Financial Officer

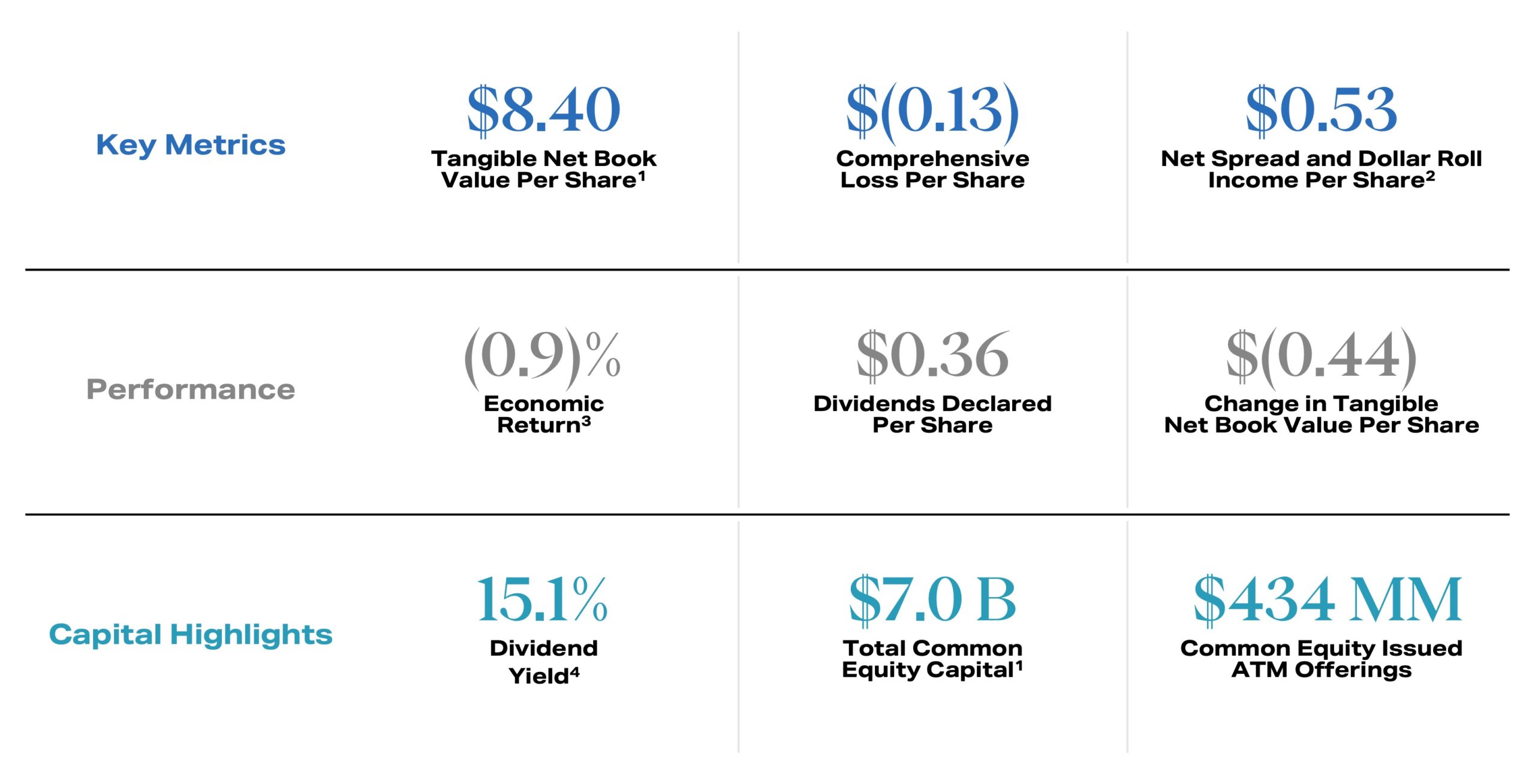

For the second quarter, AGNC had a comprehensive loss of $(0.13) per share given the moderate spread widening that occurred for the quarter. Economic return on tangible common equity was negative (0.9)% for the quarter, comprised of $0.36 of dividends declared per common share and a decline in our tangible net book value of $(0.44) per share. As of late last week, our tangible net book value per share was up about 2% for July, or 1% after deducting our monthly dividend accrual.

Leverage increased modestly for the quarter to 7.4x tangible equity as of the end of Q2, from 7.1x as of Q1. At the same time, our liquidity remained very strong, with unencumbered cash and Agency MBS of $5.3 billion, or 65% of our tangible equity as of quarter-end.

Consistent with the increase in interest rates, the average projected life CPR for our portfolio at quarter-end decreased 120 basis points to 9.2%. Seasonal factors drove an increase in our actual CPRs for the quarter to an average of 7.1%, up from 5.7% for the prior quarter.

Net spread and dollar roll income for the quarter remained well above our dividend at $0.53 per share. The $0.05 per share decline for the quarter was due to a decrease in our net interest rate spread of approximately 30 basis points to just under 270 basis points for the quarter, as higher swap costs more than offset the increase in the average yield on our asset portfolio.

Lastly, in the second quarter, we issued $434 million of common equity through our at-the-market offering program. Our capital management framework provides us the ability to opportunistically create incremental value for existing stockholders through book value and earnings accretion. In the second quarter, we issued stock at a substantial price-to-book premium and invested those proceeds in attractively priced assets.

Agency Portfolio Update and Performance

Chris Kuehl | EVP and Chief Investment Officer

From a macro perspective, the second quarter was similar to the first quarter in many ways, with economic data repricing Fed expectations and heavily influencing fixed income market sentiment. Strong economic data at the start of the quarter caused the market to lower its expectations for Fed easing in 2024. Fed rhetoric also turned hawkish in April, with Chair Powell expressing disappointment in the recent progress against the Fed’s inflation objective. As a result, rate volatility increased as 10-year Treasury yields moved through the upper end of the year-to-date range, ultimately reaching just over 4.7% in late April.

These macro and market dynamics, coupled with higher seasonal supply, negatively impacted Agency MBS performance early in the quarter. Market sentiment shifted, however, in May and June following weaker labor and inflation data. Notably, headline unemployment increased from 3.8% in the April nonfarm payroll release to 4% in June. Softer labor data and favorable CPI reports in both May and June allowed for a more balanced market focus on the Fed’s dual mandate of “maximum employment and stable prices.” As a result, Treasury yields and Agency MBS spreads partially retraced the negative performance by the end of the quarter.

Despite elevated rate volatility, Agency MBS traded in a much tighter range than they did during periods of stress seen last year. This is encouraging and is a result of many factors, including much stronger high-grade fixed income inflows year-to-date, the Fed’s decision to start tapering quantitative tightening (QT), stability in bank deposits, and, most importantly, a growing consensus, firmly rooted in economic data, that the Fed may begin normalizing rates over the next couple of months.

During the second quarter, we added approximately $3 billion in Agency MBS and, as a result, the investment portfolio increased to $66 billion as of June 30th. Our TBA position declined by $3 billion as conventional rolls traded somewhat weaker, and we opportunistically added approximately $6 billion in specified pools, most of which were in lower pay-up categories. Our Ginnie Mae TBA holdings in aggregate were largely unchanged as of June 30th, as valuations remained attractive and roll-implied financing rates continued to offer a significant advantage versus repo funding.

Our hedge portfolio increased to $58.8 billion as of June 30th, largely due to the increase in our asset portfolio. During the second quarter, we continued to gradually shift the hedge composition to a heavier allocation of swap-based hedges. As a result, swap-based hedges currently represent approximately 65% of our hedge portfolio on a duration dollars basis. Our swap-based hedges were a drag on our book value performance in the second quarter as swap spreads tightened five to eight basis points across the yield curve.

Lastly, the data dependent nature of Fed policy will likely continue to create some volatility in markets, but the earnings environment for Agency MBS remains very favorable with historically wide spreads, low levels of prepayment risk, and liquid financing markets.

Non-Agency Portfolio Update and Performance

Aaron Pas | SVP, Non-Agency Investments

Credit spread performance in the second quarter was mixed, with some areas widening marginally while others were a bit firmer. Early in the quarter, spreads across credit products generally weakened as rates tested local highs. Subsequently, the backdrop of improving inflation readings and a softer employment outlook, combined with relatively high issuance in the structured product market, led to the divergent performance of credit products during the quarter. As an indicator of credit spreads in the second quarter, the synthetic investment-grade and high-yield indices widened by approximately three and 14 basis points, respectively. This widening retraced just over half of the tightening we saw in the first quarter.

Credit fundamentals remain consistent with past trends we have noted, showing a bifurcated consumer base. Lower-income households are currently stretched, as reflected by increasing auto loan and credit card delinquency rates. Conversely, higher income or wealthier households appear to be in reasonably good shape.

Turning to our portfolio, our portfolio of non-Agency securities ended the quarter at $940 million, down roughly 10% from the prior quarter-end. This decline was largely anticipated and driven primarily by our participation in the GSE tender offers for its outstanding credit risk transfer securities. Additionally, a significant portion of our CMBS holdings paid off or paid down in the second quarter. In both segments of the non-Agency portfolio, we were able to opportunistically re-deploy a portion of the freed-up capital. Lastly, the funding landscape for non-Agency securities remains stable and relatively attractive by historical standards.

Important Disclosures

This commentary includes excerpts from AGNC Investment Corp.’s (“AGNC”) Q2 2024 earnings call. Click here to listen to the full webcast and access the earnings release and presentation.

Per share amounts are per share of common stock, unless otherwise indicated. Income and loss per share amounts are per diluted common share, unless otherwise indicated.

1. As of June 30, 2024. Tangible Net Book Value Per Share and Total Common Equity Capital are net of the preferred stock liquidation preference. Tangible Net Book Value Per Share excludes goodwill.

2. Net Spread and Dollar Roll Income Per Share (f/k/a Net Spread and Dollar Roll Income, Excluding “Catch-Up” Amortization, Per Share) represents a non-GAAP measure. Refer to our Q2 2024 Stockholder Presentation for a reconciliation and further discussion of non-GAAP measures.

3. Economic Return represents the sum of the change in tangible net book value per common share and dividends declared on common stock during the period over the beginning tangible net book value per common share.

4. Dividend yield as of June 30, 2024.

These materials contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are based on estimates, projections, beliefs and assumptions of management of AGNC at the time of such statements and are not guarantees of future performance. Forward-looking statements involve risks and uncertainties in predicting future results and conditions. Actual results could differ materially from those projected in these forward-looking statements or from our historic performance due to a variety of important factors, including, without limitation, changes in monetary policy and other factors that affect interest rates, MBS spreads to benchmark interest rates, the forward yield curve, or prepayment rates; the availability and terms of financing; changes in the market value of AGNC’s assets; general economic or geopolitical conditions; liquidity and other conditions in the market for Agency securities and other financial markets; and legislative and regulatory changes that could adversely affect the business of AGNC. Certain factors that could cause actual results to differ materially from those contained in the forward-looking statements are included in AGNC’s periodic reports filed with the Securities and Exchange Commission (“SEC”). Copies are available on the SEC’s website, www.sec.gov. AGNC disclaims any obligation to update or revise any forward-looking statements based on the occurrence of future events, the receipt of new information, or otherwise.

We use our website (www.AGNC.com) and AGNC’s LinkedIn and X accounts to distribute information about the Company. Investors should monitor these channels in addition to our press releases, SEC filings, and public conference calls and webcasts, as information posted through them may be deemed material.